Market rarely pays for businesses with

- Poor industry dynamics

- Crooked managements

- Shady Corporate Governance Practices

Our Process

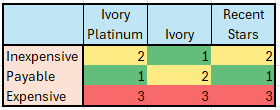

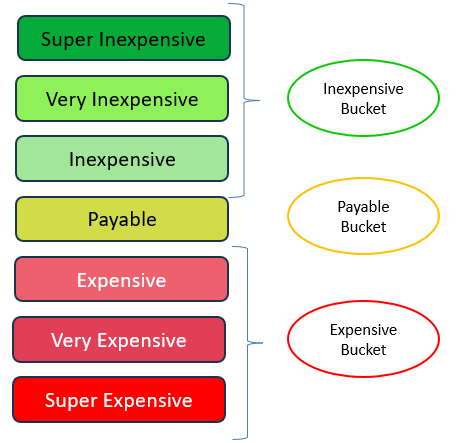

Based on the relevant operating parameters of a particular sector, considering the cyclicality, seasonality, volatility of fundamentals and most importantly the financial performance history, the companies are valued in following buckets

The methodology when tested along with business quality for the returns generated gets validated empirically. For a long history, we see that when ranked the companies on return profile, the valuation is often the most critical factor in returns.