GUEST POST

Markets has no place for eternal cynics/pessimists and an generally optimism is a good trait to have but overoptimism has killed more investors than those who have benefited. Often a balance of optimism and careful cynicism for a large amount of BS that exists, is needed to be a level headed investor. I enjoy conversing with investors who have the talent to thrash an idea and look for holes in theories not only by giving opposite point of views ( we have too many fashioned contrarians than factual ones) but also can back it up with solid research. In one of a similar conversation many years back, I interacted with Varadha. We have discussed many companies after that and I have liked his perspective and thought process a lot.

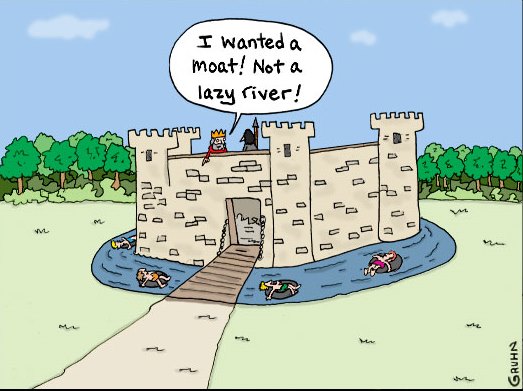

So today’s post is a guest post my good friend, Varadha. He intended to write on companies with moats but in his typical fashion of debunking myths, he has presented the point of view that most established moats are most profitable investments in the time when they are in the making rather than after they have established their moats.

In this part of the series, the attempt is to show the quantitative parameters that are most crucial to track for such companies. This is purely an unadulterated view point. My opinions have not been mixed with his thought process.

Over to Varadha

Having read a lot of books on investing ranging from Warren buffet’ pearls of wisdom to Howard marks’ memos to George Soros’s theses on reflexivity, I was always intrigued by one thing – how to translate these precious thoughts into practical, malleable mental models in the world of investing. The thought of weaving practical experiences into these wisdoms, mental models and mind maps always stuck me as an empty space that no one has attempted before. Hopefully, I can make this start better and sharper as we go along the way. I also realized that the modern day investor does not have the luxury of time and often looks for a distillation that he can then file into his mental attic in a way that makes him see the world in a smarter light.

How to spot a widening moat

Who does not like to figure out a moat in a business – everyone does know s that a moat lends itself only to a “nominal” measurement. Over a period of time, one realizes that a business is a function of several operational, financial and governance levers. Of this, the financial and operational levers are often the easiest to spot and can be quantified. The governance lever which is often a precursor to improved transparency and sharing of wealth with minority share holder requires often reading subtle signals.

Operational Levers

Rare is a company that is able to grow sales in excess of 20% – rarer still is a company that can grow margins (gross, EBITDA) too along side sales. The traits, that over the last few years I have observed, have delivered enormous share holder value include:

Financial/Operational levers

Primary signs to watch out for :

- Sweating assets and improving collections(fixed, inventory and debtors/creditors): An increasing trend in indicators like fixed asset turnover, shrinking debtors and improving cash conversion cycle is often an indication that the company is able to incrementally squeeze out more and more cash from its operations. Often, a shrinking balance sheet with improving cash flows is a precursor to good times ahead. An additional cherry on the cake would be one-off cashflows (note- not one-off gains from disposal of non-core assets/real estate etc although if the amount is material, these could help provide liquidity to improve the company’s operations).

- Reduction in debt/improving operating cash flow to sales: The two surest signs of a company improving its financial health are improved operating cash flows and a reduction indebtednesss/increase in cash balances. The logic of this is not hard to fathom

Secondary signs to watch out for

- Improving ROE/ROCE/cash yields :The primary signs often lead to superior value creation for share holders ROE/ROCE’s expand. Of particular interest though are cash yields – increase in operating cash flow yields without a commensurate increase in investing cash flows is a good sign. A caveat here though is to understand capacity utilization and understand when the next wave of capital expenditure/WC would be needed. Ideally the capex ought to have been completed in the near past with enough head room for capacity utilizations to expand/very little incremental WC needed.

- Increase in dividends/buy backs: Dividends and buy backs are real cash that go to minority share holders. Growth in dividends at a higher pace than the growth in profits often is a precursor to a widening moat – simply because the business can share more wealth than what is indicated by its accounting profits. Of course, this has to be looked at in the context of overall dividend pay out too.

- Awards/breakthroughs: Often companies get into a new orbit if they break in with new products/break into new customers etc.

Mayur uniquoters – delivering value

“Mayur uniquoters in 2010 was a full toss free hit – 50 %+ sales growth, margins jumping 200-300 bps every year, and assets being sweated rapidly. You could see that in the operating cash flows and ROCE that jumped up rapidly with a shrinking DSO – it was like an aircraft on after burner – all engines firing and the stock price couldn’t have been too behind.”

For example look these figures from www.screener.in on Mayur uniquoters a stock that delivered astounding returns between 2010 and 2014. You can see from the below that :

- Fixed asset turn over went up from 3.66 in 2009 to 5.68 in 2013 – indicating a sweating of its assets

- Receivable days went down from 48 days in 2010 to 43 days in 2014

- On the flip side cash conversion cycle actually decreased from 4 days to 28 days

To validate this further, let us examine the cash flows. Even when two out of three engines fire, look at the jump in operating cash flows, often a key metric of share holder return. If someone could see a little more to detail, they would have realized that the company invested Rs. 7 Cr. In 2009 the benefits of which started translating from 2010. See how they tie-up with the repayment of loans (cash flow from financing at a negative Rs. 6.86 Cr. And Rs. 11.10 Cr respectively).

What’s interesting is that the company has been consistently able to maintain its ROCE’s at 50 % + till 2014 avoiding the usual mistakes of di-worse-fication or accumulating excess cash (that drags down the ROE)

Inversion – what to avoid

Let us look at another example where I lost a lot of money in the process – Mandhana industries limited. With hindsight, some of these governance issues were glaringly obvious. See the table below (courtesy : www.ratestar.in) and its blindingly obvious that on every front the company was slipping – slowing sales growth, worsening collections, increasing debt and poor conversion of cash. What’s important is to see the increase in debt that made matters worse because unlike equity, debt does not give you room to collect your breath and run.

What’s obvious immediately here is the worsening cash conversion if you notice below. Loading debt on top it would have been a recipe for disaster – but of course, I did not notice it until the damage was done

To summarize the learning from the above, what’s important is to develop a sense of how balance sheet, profit and loss and cash flows influence get impacted by changes in business – one of the key things to watch out for is the cash conversion cycle. While very few companies will get all four engines right – improving margins, increasing sales, shortening working capital cycle and improving ROCE’s, if one can get 2 or 3 out of these four, it may be worth digging more.

About the Author

Varadha is a self taught investor with a passion for grounds-up research and digging deep for primary insights through primary/secondary research in the eco system. He has a passion for behavioural finance and forensics and is passionate about how money flows through the economy and the impact it has on real lives. He is an active contributor on stock and economic discusssion websites and blogs on issues that affect valuations.

He graduated from IIT/IIM and wandered around for two years to discover himself and his passion after having worked in investment banking and M & A for almost a decade.