Who we are?

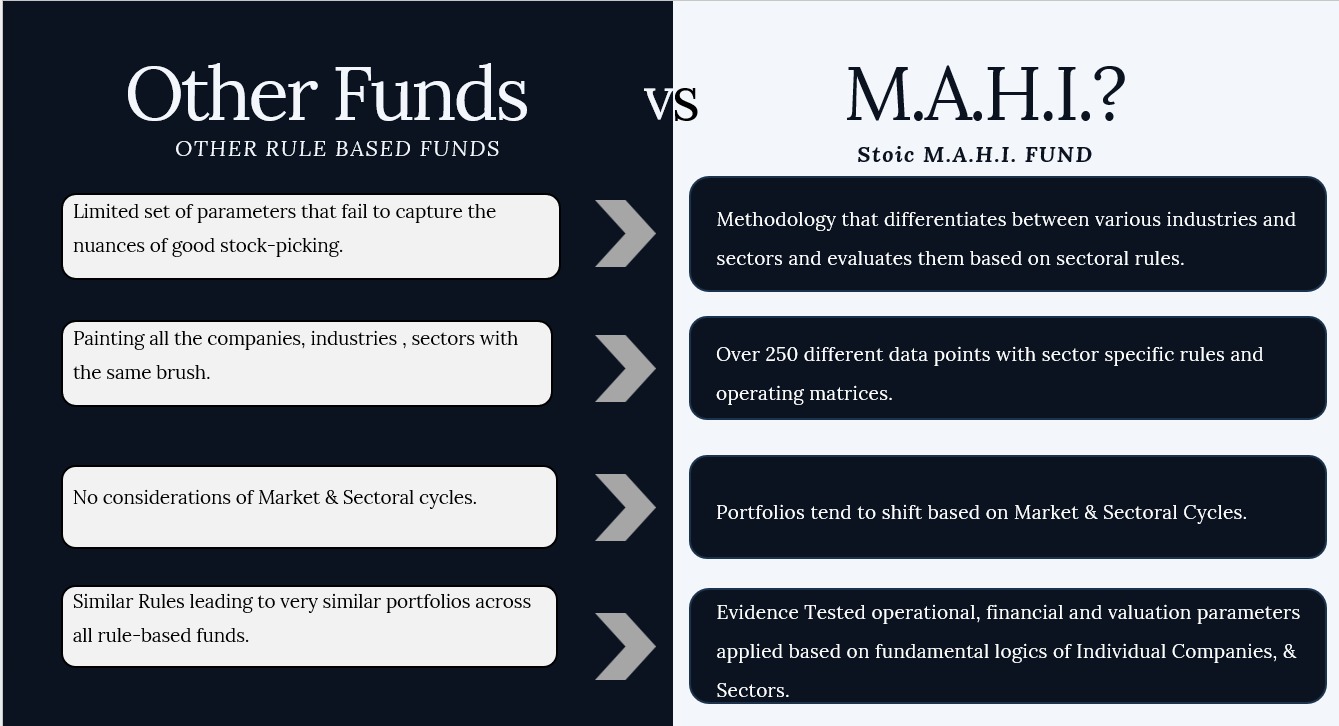

Stoic M.A.H.I. Fund is an actively managed fund that utilizes a unique, evidence-driven, rule-based approach to investing in equities, going beyond conventional methods. Our focus is to generate returns for our Investors across market cycles with minimum volatility. Our years of research has given us a framework that leverages technology and human intelligence to simplify and strengthen our investment decision making.

Why M.A.H.I.?

The M.A.H.I. Way

Risk Management- What does the evidence say?

“Lot of investor’s focus is on what stocks to pick, but in Investing, what is not to be done is more crucial than what is to be done. That is why our first focus is to eliminate rather than select”.

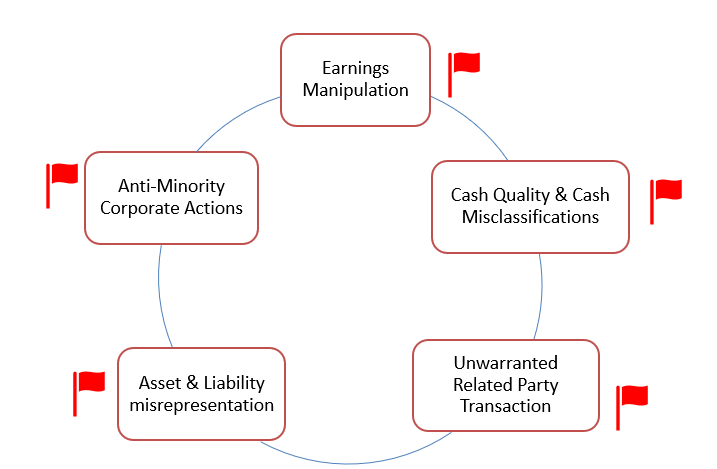

Based on the evidence, we have identified sources of risk and built our processes of mitigating them

Market rarely pays for businesses with

- Poor industry dynamics

- Crooked managements

- Shady Corporate Governance Practices

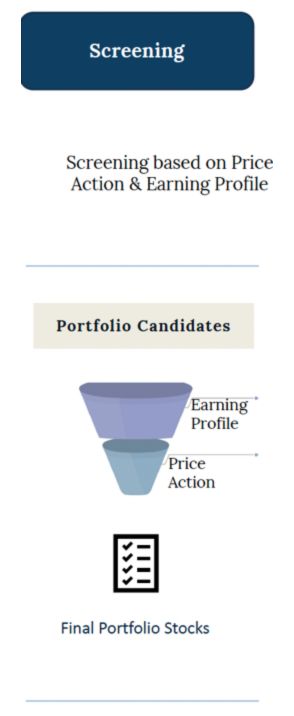

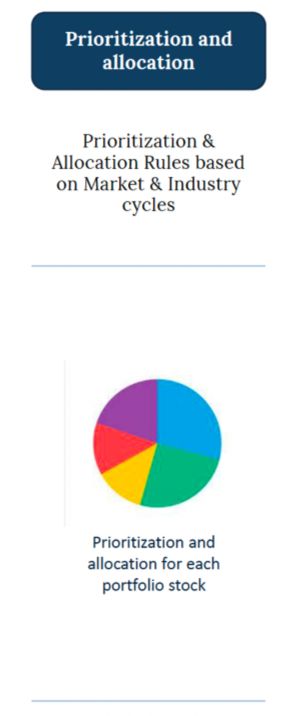

Our Process

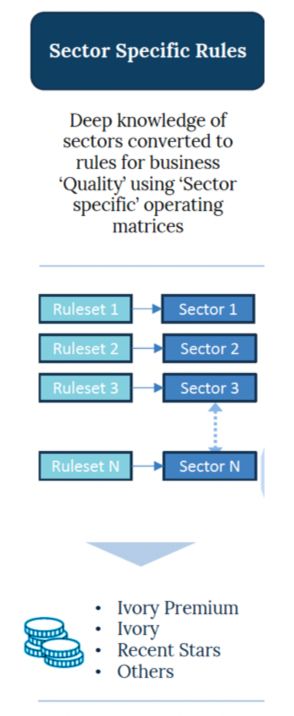

In different sectors, based on industry characteristics and operating matrices of companies, businesses are classified as:

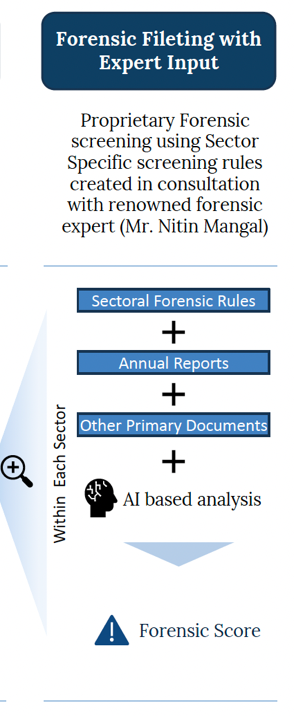

- Poor Accounting Practices

- Fraudulent Transactions

Our Process

Forensic Framework created in collaboration with renowned forensic expert : Mr. Nitin Mangal. There are different critical parameters and different threshold values based on sectors. A comprehensive forensic score is created to filter out the ‘bad apples’.

Market rarely pays for businesses with

- Poor industry dynamics

- Crooked managements

- Shady Corporate Governance Practices

Our Process

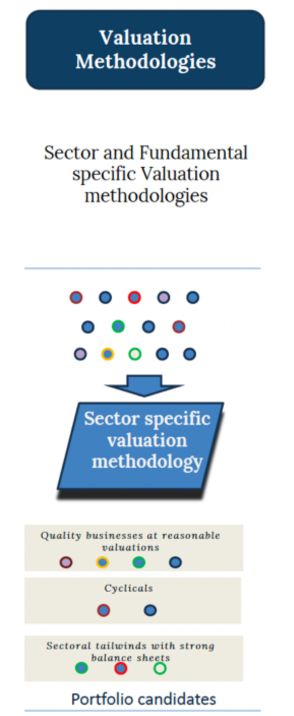

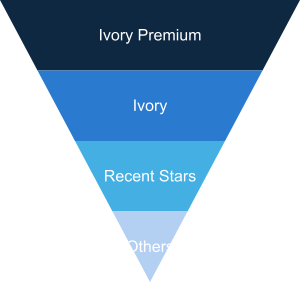

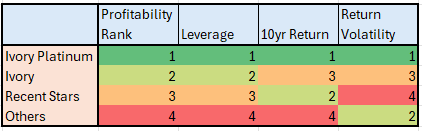

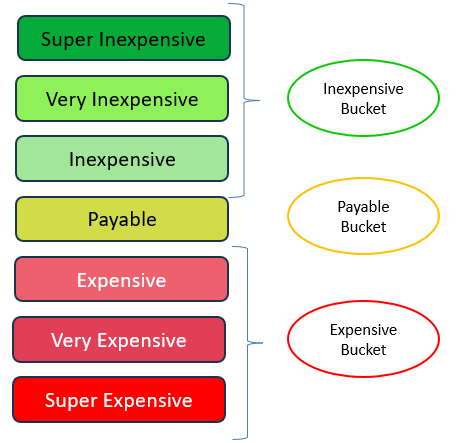

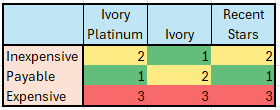

Based on the relevant operating parameters of a particular sector, considering the cyclicality, seasonality, volatility of fundamentals and most importantly the financial performance history, the companies are valued in following buckets

The methodology when tested along with business quality for the returns generated gets validated empirically. For a long history, we see that when ranked the companies on return profile, the valuation is often the most critical factor in returns.

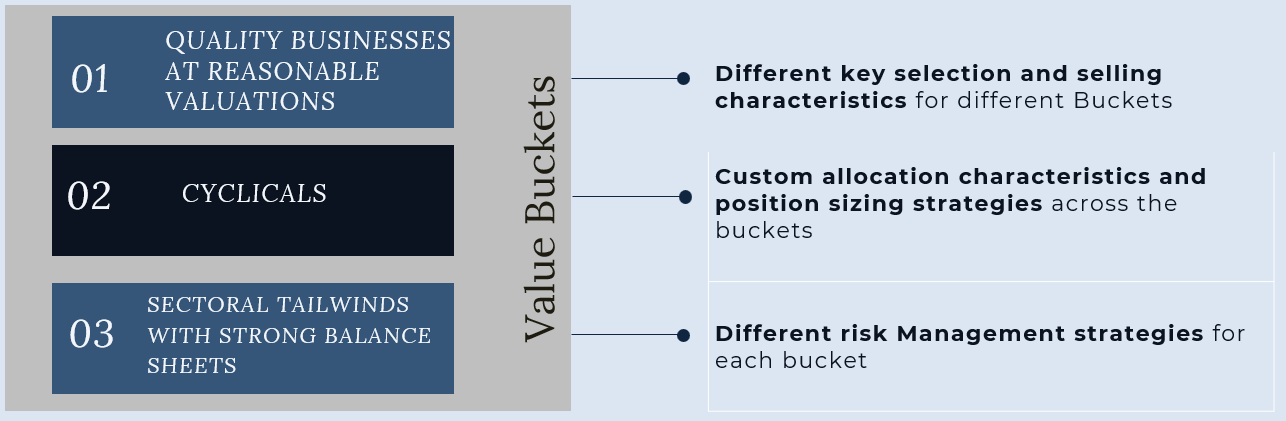

Based on evidence driven examination of key characteristics of the winning stocks, Stoic Portfolio Construction process bifurcates stocks in different ‘Value Buckets’:

Mind Behind M.A.H.I.

Puneet Khurana, CFA®

The Stoic Advantage

If we find a sector showing promise, we don’t simply ignore it because it is out of ‘competence zone’. Investing is about constant learning and expanding the circle of competence. Instead of shying away from unfamiliar sectors, we embrace opportunities to learn and invest in new areas where evidence supports potential returns.

We recognize that value can be found across different market capitalizations. Ideally, we prefer mid and small caps but on occasions more value is in large caps vis a vis mid and small cap companies and if evidence suggests greater value potential, we shift our focus.

Fund at a glance

Fund Category

AIF - CAT 3

Inception

December 9, 2024

Benchmark

NSE 500

Market Cap

Across the market

Stocks in Portfolio

25-30

Investment Approach

M.A.H.I. Way

Investment Style

Good Quality at Reasonable Valuation

Investment Horizon

Medium to Long Term

FAQs

Category III AIFs are investment funds that employ complex trading strategies, including leverage and hedging, to generate short-term returns. These funds can invest in a variety of financial instruments, such as listed and unlisted securities, derivatives, and structured products.

As per the SEBI Regulations, the minimum investment amount is ₹1 crore.

Income earned by Category III AIFs is subject to taxation at the fund level. When you withdraw your investment in the AIF, you do not have to file for or pay any taxes.

Category III AIFs invest in a broad range of assets including:

- Securities of listed and unlisted companies

- Derivatives

- Structured products

- Other AIF units

There is no lock-in period, however 2.0% exit load will be charged if redemption occurs within 12 months of date of issuance of units.

When you invest in the AIF, the units will show up in any existing demat account of yours. The value of these units will be updated on a monthly basis. You will also receive account statements in your registered email and will be able to login to our RTA’s portal to download portfolio factsheets, tax reports and other relevant documents.