Flagship Multicap

Stoic’s Flagship Multicap portfolio invests in a concentrated portfolio of great franchises which consist of Quality at reasonable valuation, Sectoral Tailwinds and Cyclicals that can drive earnings growth in short to medium time frame.

Investment Objective

Our Objective is to maximize wealth by investing into equities, whereby we seek to generate an average of 20% CAGR over a 5-year rolling basis

How Do We Achieve It!

By investing in equities which meet our stringent investment criteria of Value, Growth and Quality.

Simultaneously Managing Risk by eliminating investment options that are destructive to the Investor’s Capital

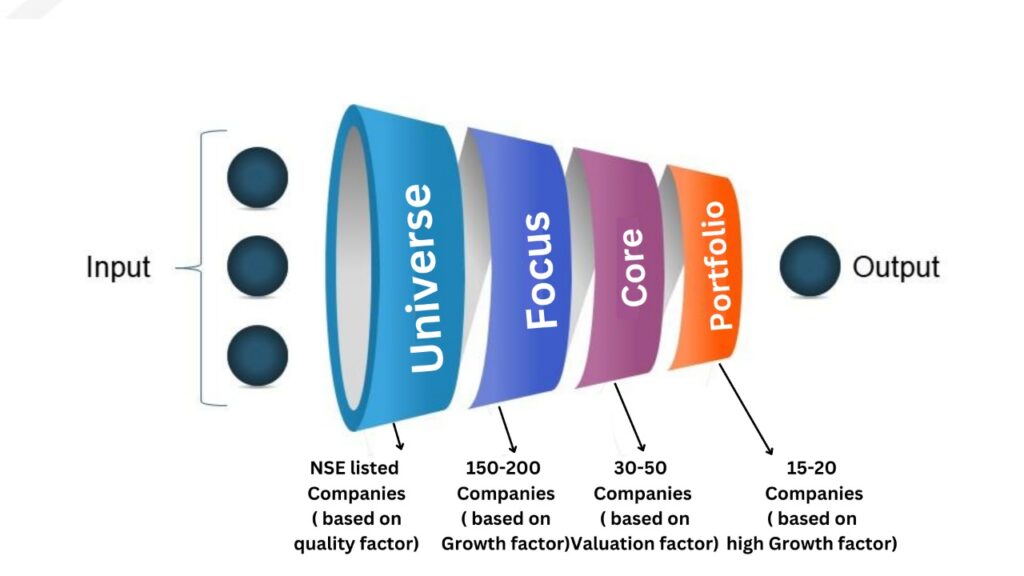

Portfolio Construction Philosophy

Based on evidence driven examination of key characteristics of the winning stocks, Stoic “ Flagship Multicap” Portfolio Construction pays attention to the following criteria:

- Sectors closer to the bottom of their respective business cycle

- Businesses with ability to ride the down cycle

- Businesses with operating leverage for outsize gains during the up cycles

- Key sectoral data pointing to possibility of cyclical reversals

- Deep value present in valuations

Based on evidence driven examination of key characteristics of the winning stocks, Stoic “ Flagship Multicap” Portfolio Construction pays attention to the following criteria:

- Sectors closer to the bottom of their respective business cycle

- Businesses with ability to ride the down cycle

- Businesses with operating leverage for outsize gains during the up cycles

- Key sectoral data pointing to possibility of cyclical reversals

Based on evidence driven examination of key characteristics of the winning stocks, Stoic “ Flagship Multicap” Portfolio Construction pays attention to the following criteria:

- Sectors closer to the bottom of their respective business cycle

- Businesses with ability to ride the down cycle

- Businesses with operating leverage for outsize gains during the up cycles

- Deep value present in valuations

Portfolio Sneak Peak

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

- Sectors closer to the bottom of their respective business cycle

- Businesses with ability to ride the down cycle

- Key sectoral data pointing to possibility of cyclical reversals

- Deep value present in valuations

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

- Sectors closer to the bottom of their respective business cycle

- Businesses with ability to ride the down cycle

- Key sectoral data pointing to possibility of cyclical reversals

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

- Sectors closer to the bottom of their respective business cycle

- Businesses with ability to ride the down cycle